How to Winterize Your Northern Virginia Rental Property

Winter’s chill is no joke, especially when it comes to rental properties in Northern Virginia. Knowing how to winterize a rental property is paramount. It’s important to seal up leaks that let warm air slip away, understand why gutters need clearing before snow hits, and see how a little TLC for your HVAC system now can save you big headaches later.

Additionally, insulating pipes can be your best defense against water damage from burst pipes—a nightmare scenario during freezing temperatures. And because we know that teamwork makes the dream work, we’ll talk strategies on getting tenants involved too—because everyone plays a part in safeguarding their home against Old Man Winter’s worst.

The Necessity of Winterizing Your Northern Virginia Rental Property

Think about winter in Northern Virginia, and you’ll conjure up images of cozy firesides—not busted pipes and insurance claims. That’s why smart landlords know that to winterize a rental property is not just good practice; it’s essential for protecting your investment from the freezing kiss of Jack Frost. By taking steps now, you sidestep the chaos of emergency repairs during snowstorms.

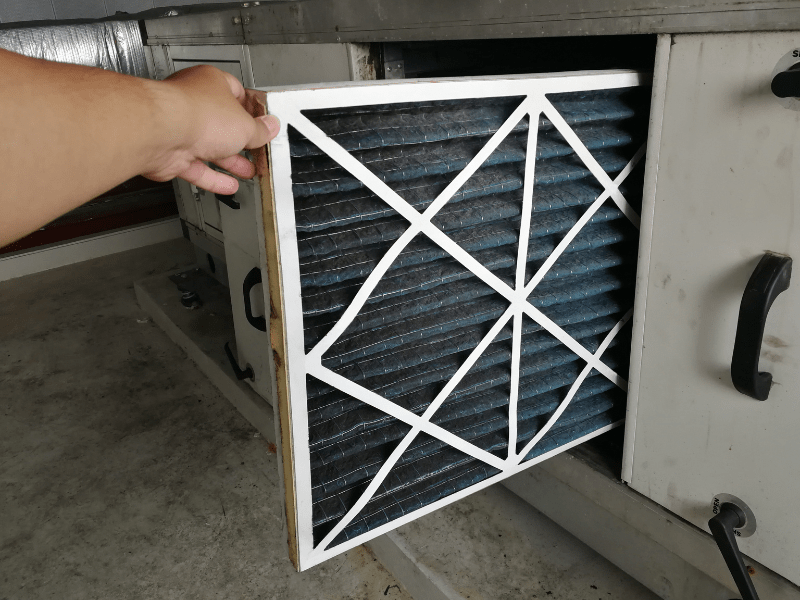

Taking care of hose bibs before they turn into ice sculptures can save you from the headache of water damage come spring. Simple tasks like covering them with insulation or installing frost-proof models are easy wins against Mother Nature’s colder moods. But let’s not forget about what goes on inside—the HVAC system needs love too. A fresh filter isn’t just a breath of fresh air for tenants; it keeps your heating unit running efficiently and slashing those energy bills.

And speaking of thermostats, programming them might seem like rocket science but think more along the lines of savvy economics—maintaining a consistent temperature uses less fuel and prevents internal climates akin to Arctic expeditions.

Quality replacement windows are important guardians against icy drafts as well. Combine this with regular inspections and prompt maintenance responses, and watch tenant comfort rise alongside their appreciation for an attentive landlord—a winning combination any time.

Inspecting Foundations and Sealing Leaks for Optimal Insulation

Bear with me as we talk about something that’s not exactly the most thrilling topic—inspecting foundations. But trust me, it’s like finding money in your winter coat pocket when you realize how much heat (and cash) can slip through those tiny cracks.

Checking Windows and Doors for Drafts

If you’ve ever felt a chill while lounging by your windows, then you know what I’m talking about. It’s time to play detective around your property’s windows and doors. Those sneaky drafts are villains where warmth is concerned. Grab some caulk or weather-stripping—and seal those leaks. Gaps around these areas are notorious for inviting cold air to an unwelcome party at your energy bill’s expense.

Remember this stat: just sealing up gaps can keep out unwanted drafts effectively, making sure every dollar spent on heating stays inside.

Addressing Foundation Repairs

You might not think of moisture as a big deal until it freezes, expands, and turns small foundation cracks into home damage issues. Repair any visible cracks pronto. And let’s face it, no one likes unexpected swimming pools forming in their basement from melting snow seepage due to compromised insulation.

A sturdy base against cold weather starts with solid groundwork—a strong foundation ensures the rest of the house stands firm against colder temperatures without becoming a drain on resources…literally.

Roof Maintenance and Gutter Cleaning Before Snowfall

Think of your rental property’s roof like a knight’s shield—it’s the first line of defense against Mother Nature’s winter fury. To keep it battle-ready, improving insulation with quality replacement windows is smart, but don’t overlook basic roof maintenance and gutter cleaning.

A roofing professional can be your ally in this quest, identifying chinks in the armor that could lead to leaks. Statistics show vulnerabilities caught by inspections are crucial for preventing costly water damage—so get ahead of the game.

Snow removal companies do more than just shovel sidewalks; they’re also savvy about ice removal from roofs which prevents those dreaded ice dams that can force meltwater into places you definitely don’t want it. And while we’re talking about prevention, let’s not forget gutters—they need to be as clear as a sunny winter day to ensure proper drainage away from your property’s foundation.

HVAC System Servicing and Filter Replacement

Brace yourself, because a well-maintained heating unit isn’t just nice to have; it’s your front-line defense against cold weather. When the temperature plummets, you don’t want your tenants wrapped in blankets regretting their life choices. That’s why replacing HVAC filters regularly are critical.

But wait. Before you pat yourself on the back for swapping out filters faster than changing TV channels, remember: A seasoned pro should give that heating unit a once-over before winter stages its chilly takeover (hire a licensed HVAC technician here). This isn’t just another chore on your list—it’s ensuring peace of mind when cold weather hits hard and fast. It helps avoid those emergency calls during snowstorms when everyone wants help but nobody can get there.

Water Pipe Insulation Strategies to Prevent Freezing

Protecting pipes from freezing temperatures is essential to avoid bursts that can cause significant water damage to your property.

Insulating exposed pipes greatly reduces the risk of them freezing during sub-zero temperatures. Foam sleeves or heat tape can be used to tightly wrap the pipes and provide effective insulation.

Draining Exterior Faucets Properly

To prevent freezing and potential pipe bursts, it is important to turn off and drain outdoor faucets before the arrival of freezing weather. Neglecting this step can lead to costly water damage and repairs.

By implementing these pipe insulation and faucet draining strategies, you can protect your rental property from the harsh winter weather and avoid expensive headaches down the line.

Preparing Tenants for Winter Responsibilities

Tenants play a crucial role in keeping your Northern Virginia rental property safe from Jack Frost’s antics. By clearly laying out what they need to do, you can avoid the headache of burst pipes and sky-high energy bills.

Communicating Seasonal Maintenance Tips

To prevent waterworks, encourage keeping cabinet doors open under sinks—especially on outside-facing walls—to let warm air circulate around plumbing. Remind them that something as easy as leaving faucets dripping can prevent freezing when the temperature plummet.

Suggest reversing ceiling fans too because pushing down warm air saves money on heating costs. As much as everyone enjoys seeing snowflakes dance outside, make sure they’re ready with insulated windows because drafty rooms chill more than just bones—they inflate utility bills.

Last but not least, remind your renters that insurance policies aren’t just paperweights; checking coverage before winter sets in is smarter than betting against Tom Brady in playoff season. With cooperation from both sides—the landlord wielding professional property management skills and informed tenants—you’re set for smooth sailing through icy seas ahead.

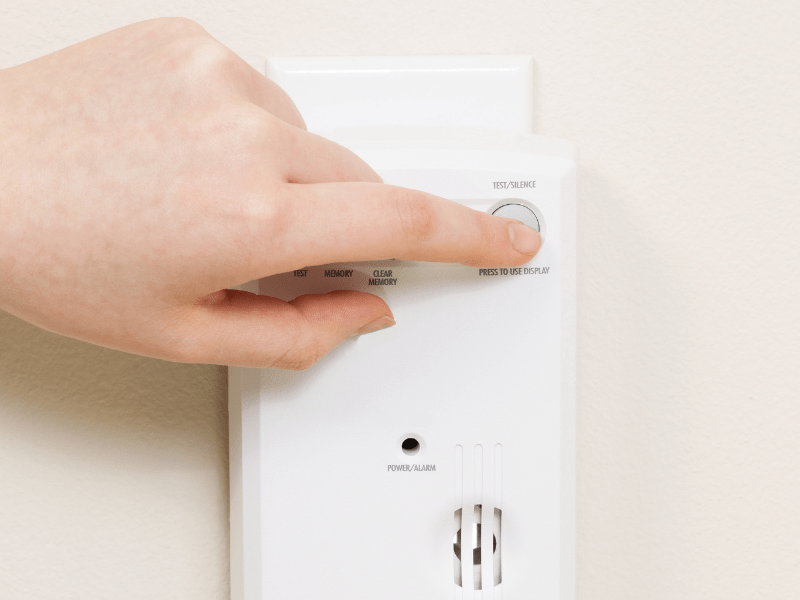

Emergency Detectors and Alerts

Silent but deadly, carbon monoxide is a real threat in cold weather when heating units work overtime. That’s why testing emergency alert systems is crucial. Make sure every detector in your property is working.

Conclusion

Remember, taking steps now to winterize your rental property in Northern Virginia means less trouble when the weather turns. Instruct tenants on their cold-weather roles—they’re essential partners in winterization.

Wrap up warm and rest easy knowing you’ve done your best preparing for winter’s chill.